Kiddie Tax 2025 Age. For tax year 2025 (taxes filed in 2025), the kiddie tax threshold will rise to $2,600. For 2025 tax year returns (which are due april 15, 2025, for most people), the kiddie tax kicks in if a child’s unearned income exceeds $2,500.

Geoff williams april 4, 2025. Kiddie tax calculator for 2025 & 2025 is an attempt to simplify the calculation of tax on income earned by kids below a certain age.for the year 2025 & 2025 , the latest on.

If you have a child with earned income or unearned income above certain thresholds, you may need to help them file a tax return.

The kiddie tax Does it affect your family? Newburg CPA, Children are subject to kiddie tax if they meet age and support requirements under the internal revenue code (irc). Who does the kiddie tax apply to?

Understanding the new kiddie tax Additional examples Journal of, For tax year 2025, the kiddie tax rule kicks in when a child’s unearned income exceeds $2,200 ($2,300 for tax year 2025). The kiddie tax is a tax provision implemented by the irs to prevent parents from transferring investment income to their children to exploit their lower tax rates.

Understanding the new kiddie tax Additional examples Journal of, Who does the kiddie tax apply to? How does the kiddie tax work?

Does the Kiddie Tax Affect Your Family? Roger Rossmeisl, CPA, The kiddie tax is a tax rule established by the internal revenue service (irs) that affects the way certain types of income are taxed for young. The kiddie tax age increased since then, and new rules took effect in 2018 and changed again in 2025.

Kiddie Tax What It Is and Why You Need to Know About It, Who does the kiddie tax apply to? Children are subject to kiddie tax if they meet age and support requirements under the internal revenue code (irc).

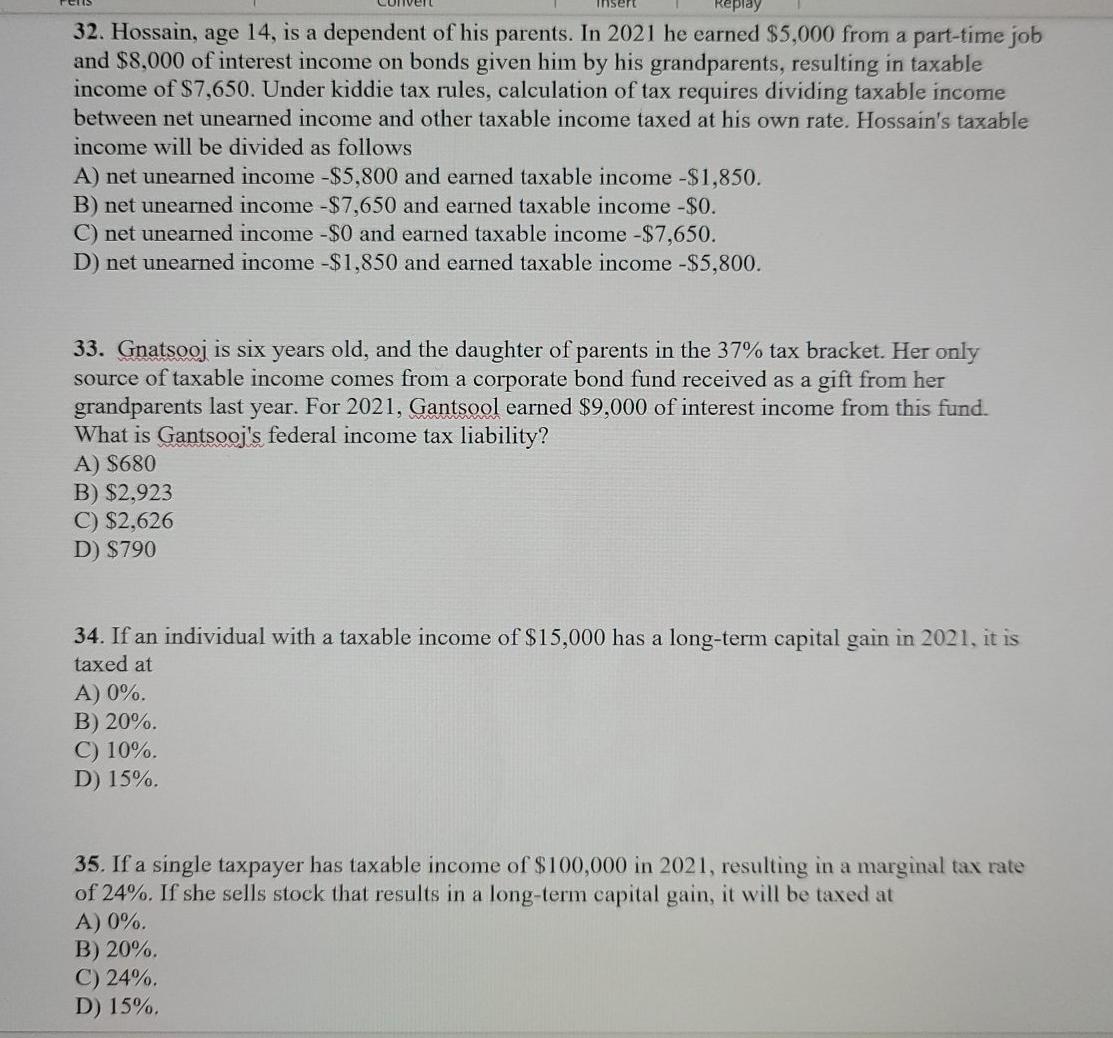

Solved insert 32. Hossain, age 14, is a dependent of his, The investment income threshold of $2,500 is broken down into two categories. As a result, if the.

WSJ Tax Guide 2019 The ‘Kiddie Tax’ WSJ, The kiddie tax age increased since then, and new rules took effect in 2018 and changed again in 2025. Kiddie tax calculator for 2025 & 2025 is an attempt to simplify the calculation of tax on income earned by kids below a certain age.for the year 2025 & 2025 , the latest on.

Will the New Kiddie Tax Rules Save You Money? The Motley Fool, Age 18 years old at the end of the tax year if their earned income is less than 50% of. Unearned income over a threshold is taxed at the parent’s rate rather than the child’s.

The IRS is not kidding about the Kiddie Tax Wegner CPAs, The investment income threshold of $2,500 is broken down into two categories. Geoff williams april 4, 2025.

The kiddie tax trap Seiler, Singleton and Associates, PA, Age 18 years old at the end of the tax year if their earned income is less than 50% of. A qualifying child might be:

Graduation Suits For Guys 2025. Cool graduation outfits for guys that will make you stand out at your graduation. Graduation…

Abc News Made In America December 12 2025. ‘world news tonight’ shares gift ideas that. During his address, the president…

Michigan Hockey Recruits 2025. Roster outlook for michigan state spartans. Beyond davis, the michigan wolverines are hosting a number of…